The total debit amount must always be equal to the total credit amount.Īssets = Liabilities + Shareholder’s Equity is known as the Accounting Equation and is a mathematical representation of the double-entry system of accounting. Under this method, each transaction affects at least two accounts one account is debited, while another is credited. General Ledgers and Double-Entry BookkeepingĪ general ledger summarizes all the transactions entered through the double-entry bookkeeping method. For accounting purposes, Company A may create three sub-ledger accounts corresponding to its three clients under account receivables (controlling accounts) to trace the amounts expected to be received from each client. If a GL account includes sub-ledgers, they are called controlling accounts.įor example, Companies X, Y, and Z are the clients of Company A. In order to simplify the audit of accounting records or the analysis of records by internal stakeholders, subsidiary ledgers can be created.Ī subsidiary ledger (sub-ledger) is a sub-account related to a GL account that traces the transactions corresponding to a specific company, purchase, property, etc.

Subsidiary ledgerįor a large organization, a general ledger can be extremely complicated. You can explore Financial Statements further with CFI’s Reading Financial Statements Course. On the ledger, each of the assets will have its own GL account. The transactions are related to various accounting elements, including assets, liabilities, equity, revenues, expenses, gains, and losses.įor example, cash and account receivables are part of the company’s assets. A GL account records all transactions for that account. General ledger accountĪ general ledger account (GL account) is a primary component of a general ledger.

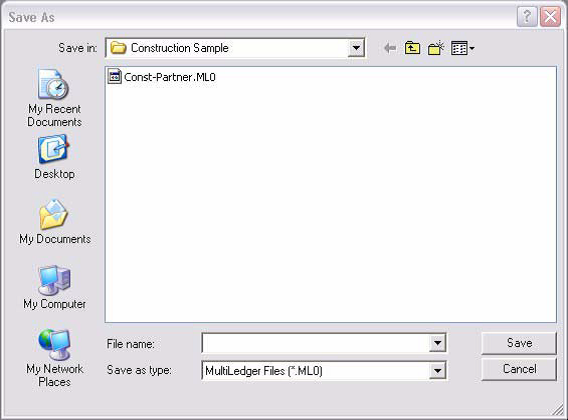

MULTILEDGER REPORTS WRONG TRIAL

The ledger’s accuracy is validated by a trial balance, which confirms that the sum of all debit accounts is equal to the sum of all credit accounts. Also, it is the primary source for generating the company’s trial balance and financial statements. In accounting software, a general ledger sorts all transaction information through the accounts.

In addition, they include detailed information about each transaction, such as the date, description, amount, and may also include some descriptive information on what the transaction was. General Ledger (GL) accounts contain all debit and credit transactions affecting them. In accounting, a General Ledger (GL) is a record of all past transactions of a company, organized by accounts.

0 kommentar(er)

0 kommentar(er)