Unfortunately, college students whose parents claim them as a dependent do not qualify for a stimulus check either. Single filers who make more than $99,000 and joint filers with income exceeding $198,000 are not eligible for stimulus payments.

Check my stimulus status full#

For married couples filing a joint return, the income limit to receive the full $2,400 is $150,000, including an additional $500 for each qualifying child.įor people who earn more than those amounts, the stimulus payment is reduced by $5 for each $100 above the $75,000/$150,000 thresholds. If you're a single adult with a Social Security number and your adjusted gross income is $75,000 or less, you'll get the full $1,200. Anyone who has not filed a 2018 return may use a 2019 Social Security statement that shows your income as reported to the IRS by an employer. If you have not yet filed your 2019 taxes, the IRS will use your 2018 return instead. To determine your eligibility, the Internal Revenue Service will use your 2019 tax return. Covid-19 stimulus check eligibility requirementsīefore we get into when your money from the government will arrive, you need to know how much money you'll be getting, if any at all. government stimulus checks have turned from a dream into a reality, what's the top question on everyone's mind? When will I receive my money? The short answer? It's complicated. You do not need to apply to receive a payment. Adults will receive an additional $500 for every qualifying child age 16 or under, and married couples without children earning below a certain threshold will receive a total of up to $2,400. Fortunately for those in need, some short-term economic relief is coming in the form of federal government stimulus checks.Īs a part of the record-setting $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act approved in late March by Congress, most adults will receive a one-time payment of up to $1,200, though the exact amount depends on your income.

More information on determining eligibility, including income requirements here.Americans everywhere have been hit hard by the Coronavirus/Covid-19 pandemic, with much of the economy in a holding pattern amid nationwide efforts to curb the spread of the virus. Are federal benefit recipients as of December 31, 2020.Did not file a 2020 or 2019 tax return but registered for the first Economic Impact Payment using the special Non-Filers portal last year.Filed a 2019 tax return if the 2020 return has not been submitted or processed yet.According to the IRS, the agency will determine eligibility and issue the third payment to Americans who: Most Americans are eligible for the third stimulus payment. Problem #3: You are not eligible for the third stimulus payment

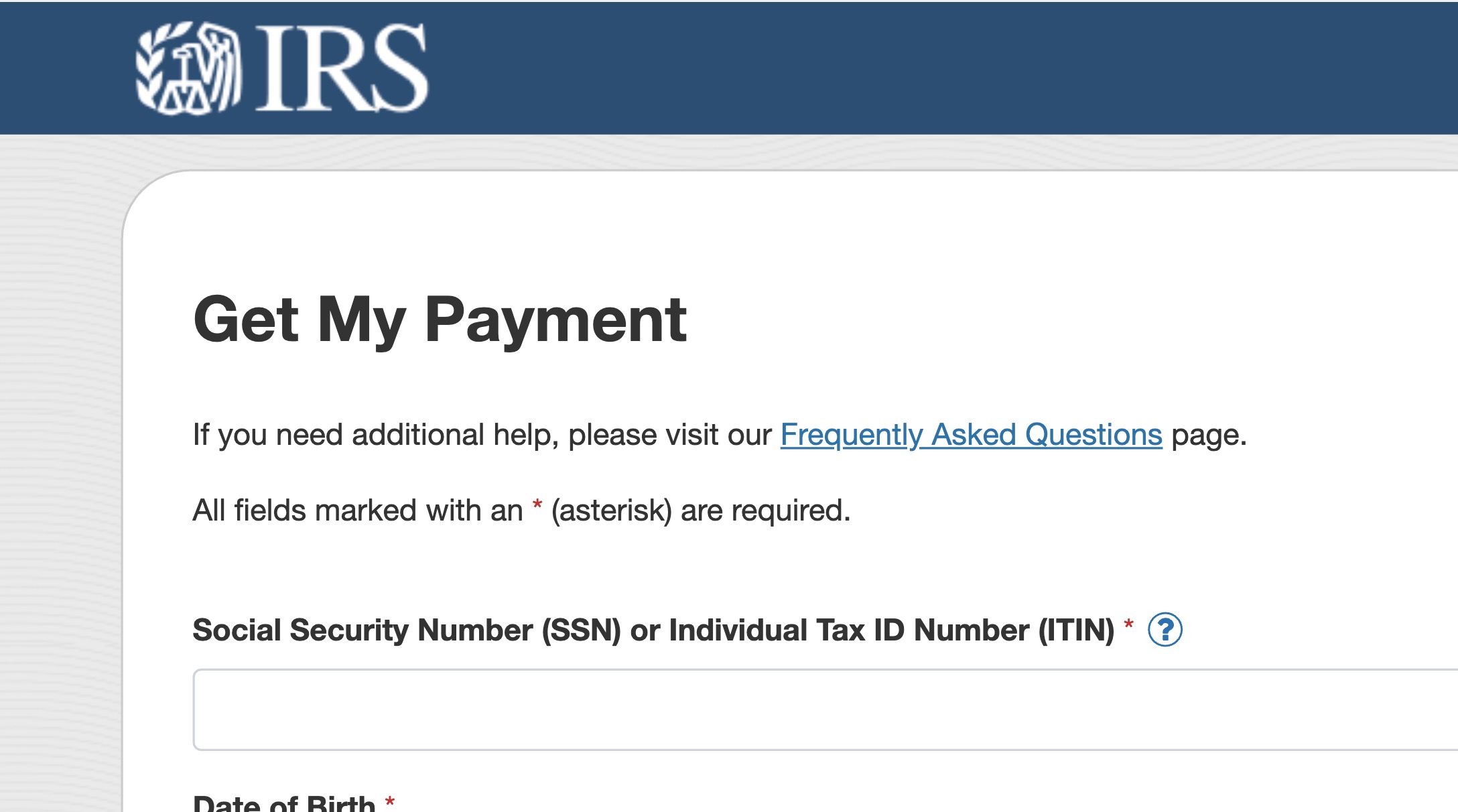

Check my stimulus status how to#

More details on how to update your information are on file here. If you do not provide updated account information, the IRS will not be able to reissue your payment. In order to have your payment reissued as a direct deposit, you can update information for a bank account, prepaid debit card, or an alternative financial product that can be associated with a routing and account number. The IRS says this means you were issued a check, rather than your payment being direct deposited into your bank account.

If “Needs More Information” displays in your results, then your payment was returned because the Postal Service was unable to deliver it. "Payment Status Not Available" could also mean that the IRS "Needs More Information" to issue your stimulus payment. Problem #2: The IRS doesn’t have enough information to issue my stimulus payment The agency says it will regularly update recipients’ status information on its Get My Payment tool and recommends checking it daily for updates on payment status. The IRS will continue to issue $1,400 stimulus payments throughout 2021. Alabama Execution Called Off Because ‘Veins Could Not Be Accessed'

0 kommentar(er)

0 kommentar(er)